WWF-Philippines, Banking Sector Call for Harmonization in Push for Sustainable Finance

November 2020

A windmill in the highlands of Pililia, Rizal. A harmonized framework for sustainable finance can help propel green developments across the country. Photograph © WWF-Philippines / Alo Lantin

Manila, Philippines – The World Wide Fund for Nature (WWF) Philippines and the Bankers Association of the Philippines (BAP) convened the banking industry for an online webinar on the 18th of September, to dispel concerns of bank managers on sustainability reporting and begin implementation of the new BSP Sustainable Finance Framework.

Entitled “The 5th BAP WWF Sustainable Finance Forum: Demystifying Sustainability Reporting,” the webinar was also a stepping stone towards developing a harmonized and flexible reporting framework for banks to adopt.

Together with the Asian Institute of Management, the University of Asia and the Pacific, the Association of Development Financing Institutions in Asia and the Pacific, and the Global Reporting Initiative, WWF-Philippines aims to support the banking industry and national recovery efforts through capacity building for sustainable finance.

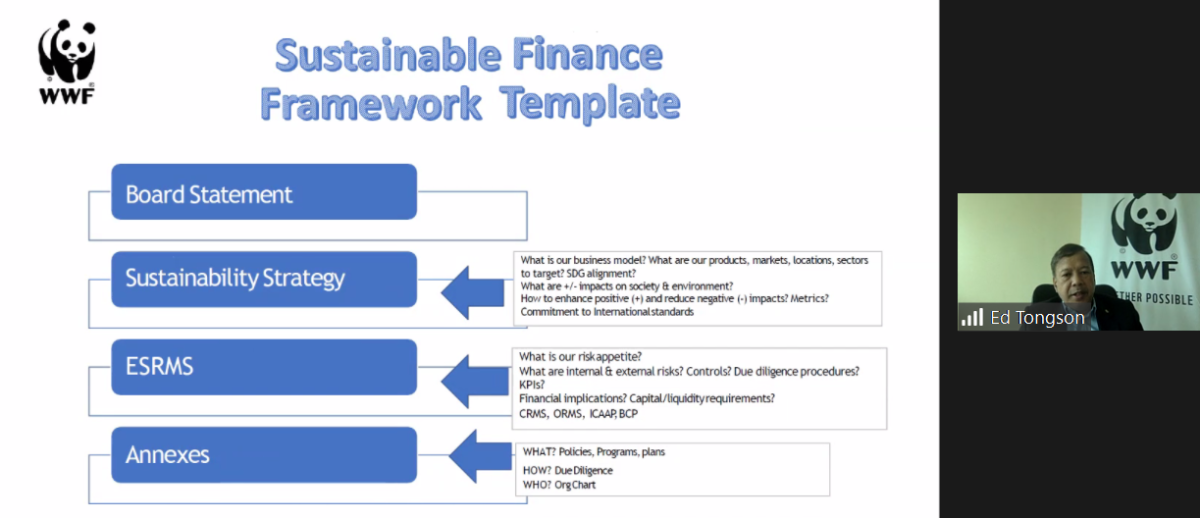

WWF-Philippines Sustainable Finance Chief of Party Ed Tongson presents a tool that banks can follow to ease into integrating sustainability principles in their governance, strategy, and risk management frameworks. Photograph © WWF-Philippines

The webinar comes after the Bangko Sentral ng Pilipinas (BSP) released Circular no. 1085 earlier this year. The circular, known as the Sustainable Finance Framework, will require banks to incorporate sustainability practices into their portfolios and business practices, and to promote Environmental, Social and Governance (ESG) principles.

Circular no. 1085 presents a major shift for the Philippine banking sector, requiring local banks to transform the conduct of their business for long-term sustainability and viability.

The webinar began with WWF-Philippines Sustainable Finance Chief of Party Ed Tongson, who detailed the stipulations put forward by Circular no. 1085. Tongson also outlined some of the concerns raised by local banks toward the new circular, and presented a tool to meet the new requirements, as well as an initiative with other development partners to harmonize reporting for comparability and transparency of sustainability-related disclosures.

Following Tongson, Development Bank of the Philippines Vice-President Paul Lazaro, recounted the DBP’s experiences with adopting and incorporating sustainability principles. With assistance from the World Bank, the DBP was among the first financial organizations in the Philippines to adopt environmental principles into their business practices. The DBP has been a champion of sustainability for the finance sector, and is a founding signatory to the UNEP FI Principles for Responsible Banking.

“We’re not going to stop with the current policies we have in place. There is still a lot for us to improve on based on this new circular,” said Lazaro.

Development Bank of the Philippines Vice-President Paul Lazaro presents the experiences of DBP as one of the first banks in the country to adopt ESG principles into their business practices. Photograph © WWF-Philippines

Bangko Sentral ng Pilipinas Managing Director Lyn Javier discussed the implications of the new circular, and what it would mean for local banks. The BSP, according to Javier, will engage banks that may make use of globally accepted frameworks in meeting the circular’s requirements.

Javier added that the new circular was not merely to outline sustainability reporting guidelines, but to promote the practice of understanding, adopting, and inculcating ESG principles into the core of each bank.

Global Reporting Initiative Public Policy and Corporate Relations South East Asia Manager Dr. Allinnettes Adigue handled questions on the wider global landscape of sustainability reporting. According to Dr. Adigue, there is a trend worldwide towards the adoption of sustainability principles, with 88% of Fortune 500 companies producing sustainability reports. GRI is one of several internationally recognized reporting frameworks that may be utilized by banks in compliance with the Sustainable Finance Framework.

Adigue added that investors have been looking at simplicity and standardization. The concern for most investors, according to Adigue, is the link between sustainability practices and financial performance.

WWF-Singapore Asia Sustainable Finance Vice President Sylvain Augoyard presented a closer snapshot of sustainability reporting in the Asia-Pacific region. Banks and financial institutions in the region, Augoyard reports, have been following international trends towards the adoption of ESG practices. With growing international support and with trillions of dollars set aside for sustainable projects, Augoyard reiterated the potential for local banks to incorporate ESG principles into their business practices.

The webinar ended with words of encouragement from Bankers Association of the Philippines Managing Director Benjamin Castillo. The BAP has been working with WWF-Philippines on mainstreaming sustainable finance since 2018.

WWF-Philippines joins AIM, UA&P, ADFIAP, and GRI in advocating for bank cooperation in the support of green developments through the Philippine Sustainable Finance Alignment Initiative. Photograph © WWF-Philippines

The financial sector plays a critical role in helping to guide the sectors that it supports towards long-term sustainability. Groups like WWF-Philippines, together with its partners, are working to help banks become drivers of sustainability, providing the financial capital needed for green development projects to flourish. Support WWF-Philippines, and help us #ChangeTheEnding for a fairer future for all.

The "Taking Deforestation out of Banking Portfolios in Emerging Markets" Project is part of the International Climate Initiative (IKI). The Federal Ministry for the Environment, Nature Conservation, and Nuclear Safety (BMU) supports this initiative on the basis of a decision adopted by the German Bundestag.

For more information, please contact:

Joseph Eijansantos

Sustainable Finance Policy Manager

jeijansantos@wwf.org.ph

Atty. Diosie Claine Avelino

Sustainable Finance Engagement Manager

dcavelino@wwf.org.ph

For media arrangements, please contact:

Ms. Pam Luber

Integrated Communications Manager

pluber@wwf.org.ph

Ms. Chezka Guevarra

Public Relations, Media, and Events Assistant Manager

cguevarra@wwf.org.ph