WWF Network Discusses the Future of Sustainable Finance in the Face of Climate Change

December 2020

WWF-Singapore Asia Sustainable Finance Vice President Sylvain Augoyard opens the event, the latest in a WWF-led webinar series entitled, “Sustainable Finance Training Roadmap for Banks.” - Photograph © WWF-Philippines

Experts from the World Wide Fund for Nature (WWF) and the United Nations Environment Programme Finance Initiative (UNEP FI) discussed the role that banks and financial institutions play in identifying and managing risks associated with water availability and climate change, as well as opportunities through bankable nature solutions, in a webinar held on the 24th of November as part of a regional training series on sustainable finance.

The event was the latest in a webinar series entitled, “Sustainable Finance Training Roadmap for Banks”, which was launched last 20th of October by Global Reporting Initiative (GRI), Association of Development Financing Institutions in Asia and the Pacific (ADFIAP), United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP), UNEP FI, and WWF. The webinar series was devised to guide banks toward enhancing their sustainable financing strategies.

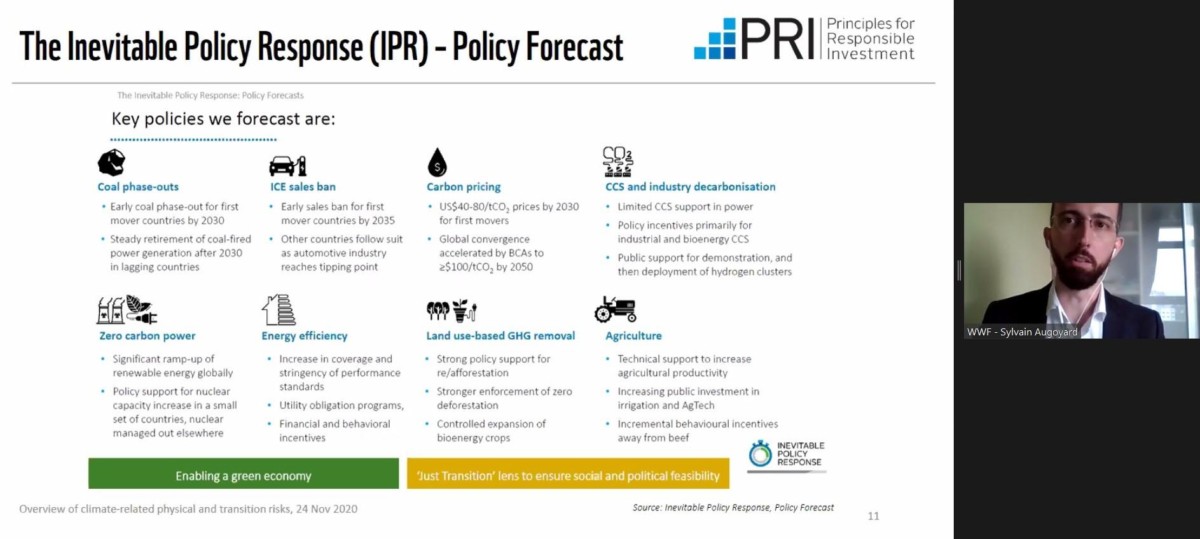

Augoyard presents the Inevitable Policy Response (IPR) Policy Forecast. For Augoyard and the WWF Network, economies will inevitably transition to sustainable practices – though the form and timing of such transitions will depend on how they react. Photograph © WWF-Philippines

The event began with WWF-Singapore Asia Sustainable Finance Vice President Sylvain Augoyard, who outlined the future environmental crisis and the risks it posed toward banks and financial institutions.

“The problem is that we are not on track… We’re still above the 1.5 degree commitment made during the Paris Agreement,” said Augoyard. While many companies have made pledges toward addressing the climate crisis – such as funding renewables or divesting from deforestation – current trends still have the world on track toward severe climate change and environmental degradation.

Heavy economic losses are expected to come with these environmental changes, explained Augoyard. The destruction of coral reefs across the globe would lead to a 25% loss in GDP worldwide by the end of the century, while 30 million jobs are expected to disappear from temperature rise alone.

Despite these challenges, banks and financial institutions are hesitant to make changes towards sustainability. Augoyard explained that a number of risks keep banks from transitioning toward sustainable practices outright – though he stressed that such a transition is both vital and inevitable.

“The question is not if economies will react, but when – and what policies they will use, added Augoyard.

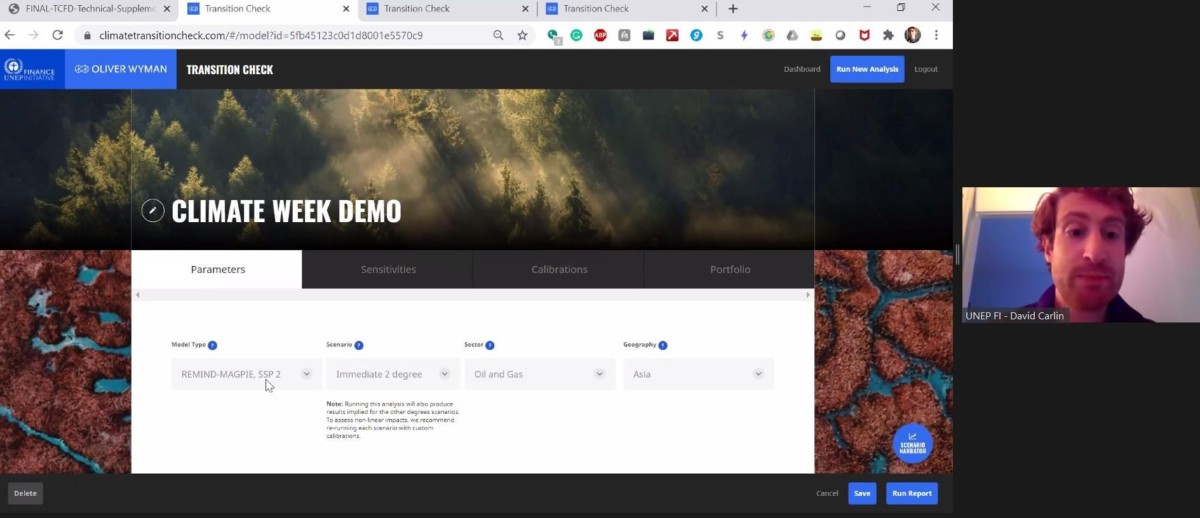

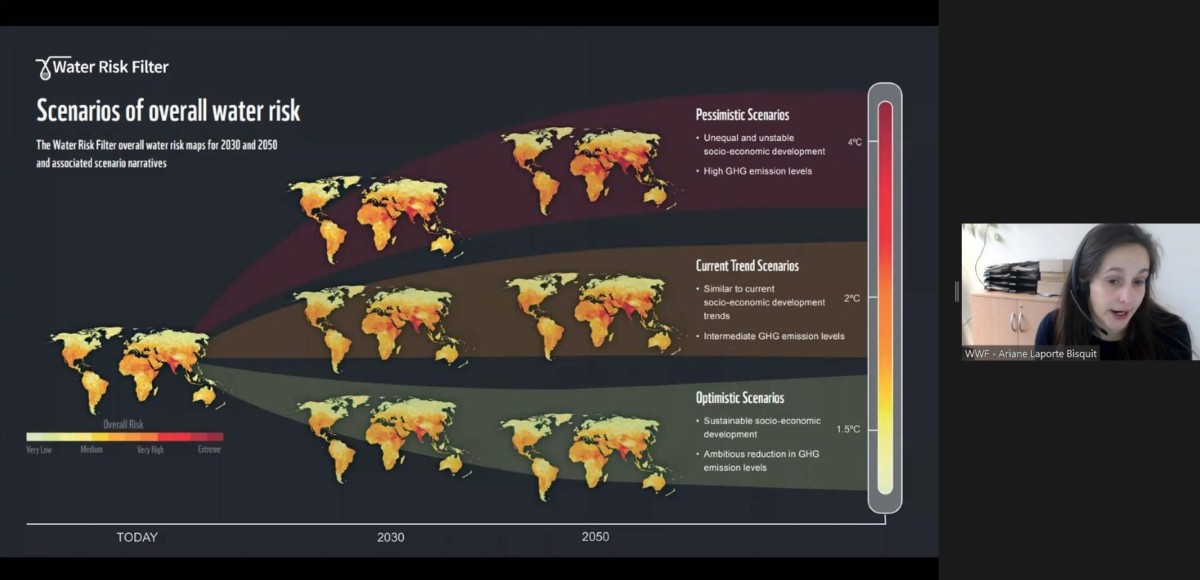

UNEP FI TCFD Banking Pilot Program Lead David Carlin presents the Climate Transition Check tool, while WWF Project Manager Ariane Laporte-Bisquit discusses the Water Risk Filter – both tools to help banks and financial institutions transition toward investing in sustainability. Photograph © WWF-Philippines

Program Lead for the United Nations Environmental Programme Finance Initiative (UNEP FI) Task Force for Climate-related Financial Disclosures (TCFD) Banking Pilot David Carlin then presented UNEP FI’s Climate Transition Check tool.

The Climate Transition Check tool inputs assumptions on climate action based on set scenarios, as designed and postulated by scientists. Banks can select a scenario, and the tool will show how different sectors will be affected over time, as the effects of climate change set in. The information from the tool serves as a guide for banks and financial institutions, suggesting to them sectors to look at and actions to take in order to mitigate the effects of climate change.

Afterwards, WWF Project Manager Ariane Laporte-Bisquit presented the WWF Network’s Water Risk Filter, a tool that looks specifically at how bodies of water will evolve with climate change, and what impact they will have on sectors and industries. Similar to the Climate Transition Check tool, the Water Risk Filter makes use of set scenarios to track changes in bodies of water, so that banks and financial institutions can make informed decisions in choosing where to invest for a climate-smart future.

Laporte-Bisquit pointed out that while concern over climate change has grown, only 17% of ASEAN banks had recognized the risks posed by changing waters. WWF’s Water Risk Filter helps banks to identify and manage these risks.

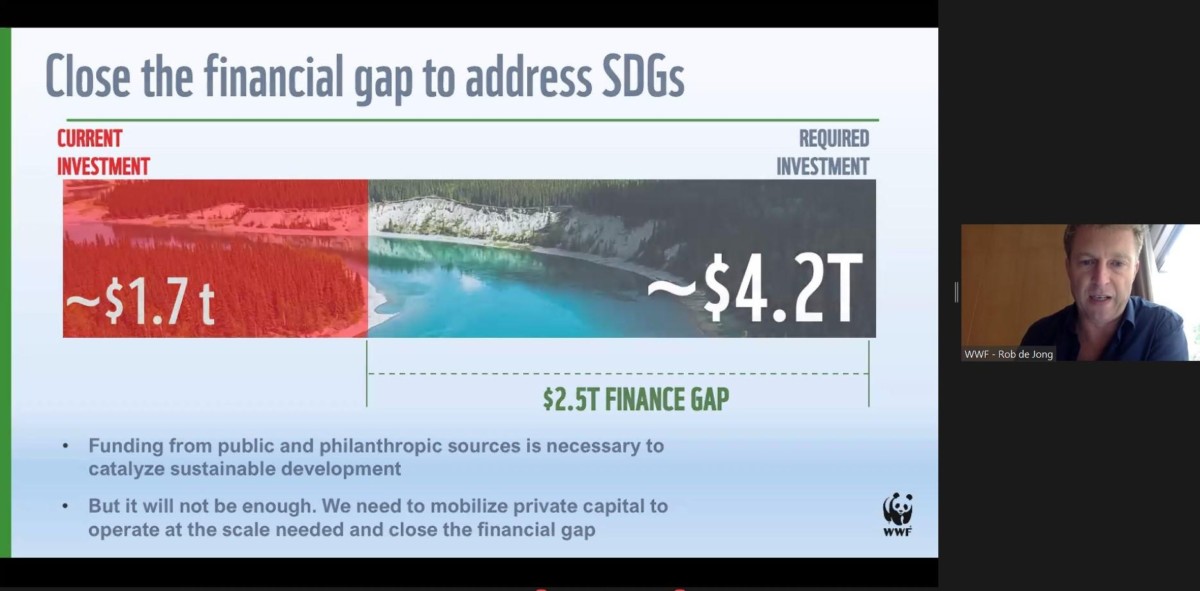

WWF-Singapore Vice President for Bankable Nature Solutions Rob de Jong discusses the investment required to properly address the SDGs. De Jong noted a finance gap of 2.5 trillion US Dollars. Photograph © WWF-Philippines

WWF-Singapore Vice President for Bankable Nature Solutions Rob de Jong then discussed the possibilities for sustainable finance and the idea of sustainability-linked loans. A sustainability-linked loan, explained de Jong, must make good on the initial investment in order to improve the environmental well-being of that which was invested in.

“What we try to stress is that they need to be ambitious, you can’t just have a loan based on the performance you will achieve. The KPIs, the ratings, the metrics must show the improvement of the sustainability profile. That’s very important,” explained de Jong.

Southeast Asian countries like Malaysia, Indonesia and the Philippines could particularly benefit from Blue Bonds, a financial instrument with funds raised from investor markets, and having sustainability KPIs linked to ocean health outcomes. These countries are faced with fishery issues that have long-term impacts both on the environment and on local and international economies. Despite this, small-scale fishers – recognized for having less of an impact on fishery ecosystems – have a hard time accessing finance institutions, and as such their traditionally selective fishing methods are overtaken by large commercial fleets.

While interest in sustainability-linked loans and sustainable financing has been growing over the years, the practice still makes up only a small part of the market. Hope persists for market share to grow rapidly though, insisted de Jong, as the sudden boom in pandemic financing proved the reactiveness of the financial sector.

De Jong presents the possibilities open for sustainable finance practices, sharing as well the importance of sustainability-linked loans in improving sustainability profiles across the globe. Photograph © WWF-Philippines

“It’s not just about grants anymore. It’s about businesses and investments with a positive effect on the environment,” added de Jong. For WWF, sustainability-linked loans and bonds that require improvements to the environment are the key to entrenching climate action into the financial sector. Such action from the sector is needed today, in order to best prepare communities in the face of the current climate crisis.

The next webinar in the series is scheduled for the 1st of December. The WWF Network will be guiding banks on how to map out climate risks, in order to help them plan out their portfolios accordingly.

The "Taking Deforestation out of Banking Portfolios in Emerging Markets" Project is part of the International Climate Initiative (IKI). The Federal Ministry for the Environment, Nature Conservation, and Nuclear Safety (BMU) supports this initiative on the basis of a decision adopted by the German Bundestag.

For more information, please contact:

Joseph Eijansantos

Sustainable Finance Policy Manager

jeijansantos@wwf.org.ph

Atty. Diosie Claine Avelino

Sustainable Finance Engagement Manager

dcavelino@wwf.org.ph

For media arrangements, please contact:

Ms. Pam Luber

Integrated Communications Manager

pluber@wwf.org.ph

Ms. Chezka Guevarra

Public Relations, Media, and Events Assistant Manager

cguevarra@wwf.org.ph